Florida Property Tax Exemption Va Disability . Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. The veteran or his or her surviving spouse must have. Web acquired property to qualify for a prorated property tax refund? Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military.

from www.exemptform.com

The veteran or his or her surviving spouse must have. Web acquired property to qualify for a prorated property tax refund? Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000.

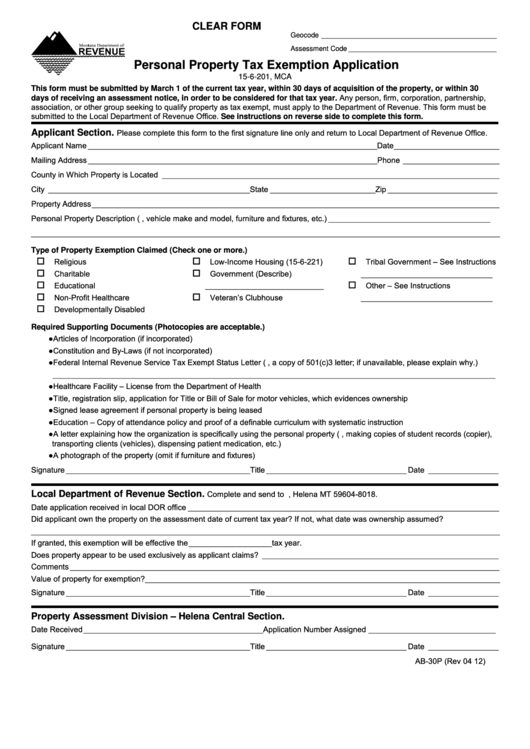

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton

Florida Property Tax Exemption Va Disability The veteran or his or her surviving spouse must have. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Web acquired property to qualify for a prorated property tax refund? Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. The veteran or his or her surviving spouse must have. Web an honorably discharged veteran with a permanent and total service connected disability is exempt from.

From www.formsbank.com

Fillable Form Boe261G Claim For Disabled Veteran'S Property Tax Florida Property Tax Exemption Va Disability Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Web acquired property to qualify for a prorated property tax refund? The veteran or his or her surviving spouse must have. Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Veterans having a service. Florida Property Tax Exemption Va Disability.

From rozellawamalia.pages.dev

How Much Is The Tax Exemption For 2024 Alisa Florida Florida Property Tax Exemption Va Disability Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. The veteran or his or her surviving spouse must have. Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web acquired property to qualify for a prorated property tax refund? Web an honorably discharged. Florida Property Tax Exemption Va Disability.

From vaclaimsinsider.com

18 States With Full Property Tax Exemption for 100 Disabled Veterans Florida Property Tax Exemption Va Disability The veteran or his or her surviving spouse must have. Web acquired property to qualify for a prorated property tax refund? Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Veterans having a service. Florida Property Tax Exemption Va Disability.

From vaclaimsinsider.com

20 States with Full Property Tax Exemption for 100 Disabled Veterans Florida Property Tax Exemption Va Disability Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. The veteran or his or her surviving spouse must have. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Web an honorably discharged veteran with a permanent and total service connected disability is exempt. Florida Property Tax Exemption Va Disability.

From www.veteransunited.com

Disabled Veteran Property Tax Exemptions By State and Disability Rating Florida Property Tax Exemption Va Disability Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. The veteran or his or her surviving spouse must have. Web acquired property to qualify for a prorated property tax refund? Web an honorably discharged. Florida Property Tax Exemption Va Disability.

From www.dochub.com

Do disabled veterans pay property taxes in florida Fill out & sign Florida Property Tax Exemption Va Disability Web acquired property to qualify for a prorated property tax refund? Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. The veteran or his or her surviving spouse must have. Veterans having a service. Florida Property Tax Exemption Va Disability.

From www.youtube.com

VA Disability and Property Tax Exemptions Common Misconception For a Florida Property Tax Exemption Va Disability Web acquired property to qualify for a prorated property tax refund? The veteran or his or her surviving spouse must have. Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Veterans having a service. Florida Property Tax Exemption Va Disability.

From www.formsbank.com

Fillable Form Boe261G (P1) Claim For Disabled Veterans' Property Florida Property Tax Exemption Va Disability Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. The veteran or his or her surviving spouse must have. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty. Florida Property Tax Exemption Va Disability.

From www.tucsonareahomesearch.com

Disabled Veteran Property Tax Exemption Florida Property Tax Exemption Va Disability The veteran or his or her surviving spouse must have. Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web acquired property to qualify for a prorated property tax refund? Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Web an honorably discharged. Florida Property Tax Exemption Va Disability.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Florida Property Tax Exemption Va Disability Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Web acquired property to qualify for a prorated property tax refund? Web an honorably discharged veteran with a permanent and total service connected disability is. Florida Property Tax Exemption Va Disability.

From www.exemptform.com

Veteran Tax Exemption Submission Form Florida Property Tax Exemption Va Disability Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Web acquired property to qualify for a prorated property. Florida Property Tax Exemption Va Disability.

From www.vrogue.co

Utility Tax Exemption Form Fill Out And Sign Printabl vrogue.co Florida Property Tax Exemption Va Disability The veteran or his or her surviving spouse must have. Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Web acquired property to qualify for a prorated property tax refund? Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Veterans having a service. Florida Property Tax Exemption Va Disability.

From www.formsbank.com

Fillable Form Otc998 Application For 100 Disabled Veterans Real Florida Property Tax Exemption Va Disability Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. The veteran or his or her surviving spouse must have. Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web an honorably discharged veteran with a permanent and total service connected disability is exempt. Florida Property Tax Exemption Va Disability.

From www.exemptform.com

Tax Exemption Form For Veterans Florida Property Tax Exemption Va Disability The veteran or his or her surviving spouse must have. Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web an honorably discharged veteran with a permanent and total service connected disability is exempt. Florida Property Tax Exemption Va Disability.

From vaclaimsinsider.com

18 States With Full Property Tax Exemption for 100 Disabled Veterans Florida Property Tax Exemption Va Disability Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. The veteran or his or her surviving spouse must have. Web acquired property to qualify for a prorated property tax refund? Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Web 11 rows further benefits are available. Florida Property Tax Exemption Va Disability.

From www.formsbank.com

Fillable Form Dor 82514b Certification Of Disability For Property Tax Florida Property Tax Exemption Va Disability Web acquired property to qualify for a prorated property tax refund? Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. The veteran or his or her surviving spouse must have. Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Veterans having a service. Florida Property Tax Exemption Va Disability.

From www.formsbank.com

Property Tax Exemption Application For Qualifying Disabled Veterans Florida Property Tax Exemption Va Disability Web 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. The veteran or his or her surviving spouse must. Florida Property Tax Exemption Va Disability.

From www.pinterest.com

All Veteran Property Tax Exemptions By State and Disability Rating Florida Property Tax Exemption Va Disability The veteran or his or her surviving spouse must have. Web acquired property to qualify for a prorated property tax refund? Web an honorably discharged veteran with a permanent and total service connected disability is exempt from. Veterans having a service connected disability rating from 10% to 99% are eligible for a $5,000. Web 11 rows further benefits are available. Florida Property Tax Exemption Va Disability.